IoT, abbreviated from the Internet of Things, refers to a connected system of devices, machines, objects, animals or people with the ability to autonomously communicate across a common network without the need for human-to-human or human-to-computer interaction. This relatively recent innovation is already revolutionizing a lot of sectors with its ability to add connected intelligence to almost everything, including smart homes, smart automobiles, smart factories, smart buildings, smart cities, smart power grids, smart healthcare, smart agriculture and smart livestock farming, to name just a few.

IoT is still a nascent innovation but it has an evolutionary trail that leads back, as per the ITU (International Telecommunications Union), to the early years of the last century.

A brief history of telemetry, M2M and IoT

A 2016 Intro to Internet of Things presentation from the ITU charts the legacy of the modern IoT revolution back to 1912, when an electric utility in Chicago developed a telemetry system to monitor electrical loads in the power grid using the city’s telephone lines. The next big milestone, wireless telemetry using radio transmissions rather than landline infrastructure, was passed in 1930 and used to monitor weather conditions from balloons. Then came aerospace telemetry with the launch of Sputnik in 1957, an event widely considered the precursor to today’s modern satellite communications era.

At this point M2M as we know it was still some years away, awaiting two landmark breakthroughs across three decades apart to propel it into the mainstream.

The first breakthrough came in 1968 when Greek-American inventor and businessman Theodore G. Paraskevakos came up with the idea of combining telephony and computing, the theoretical foundation to modern M2M technologies, while working on a caller line ID system. The second happened in 1995 with Siemens launching the M1, a GSM data module that allowed machines to communicate over wireless networks. From thereon, regular improvements in wireless connectivity, and the Federal Communications Commission’s advocacy for the use of spectrum-efficient digital networks over analog networks, paved the way for more widespread adoption of cellular M2M technologies.

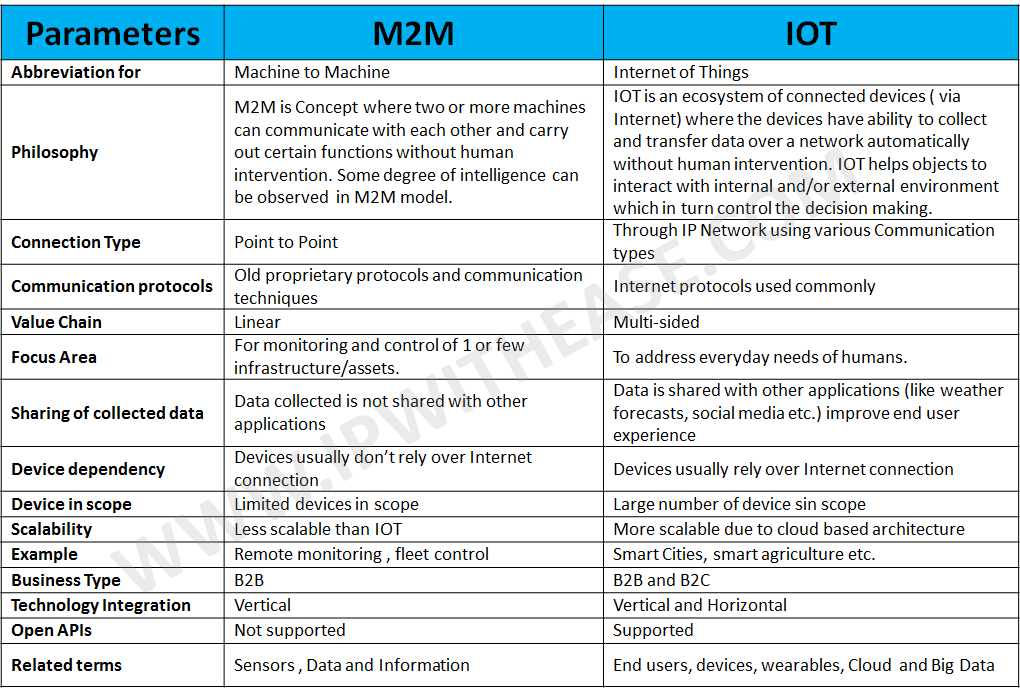

IoT is the most recent mutation in this extended evolutionary chain of autonomous machine-to-machine connectivity. However, though both approaches share the same foundational principles, there are some marked differences as shown in the chart below.

Perhaps one of the most significant distinctions between M2M and IoT is in terms of ambition and scope. Current estimates indicate anywhere between 22 and 25 billion connected IoT devices by 2025. But before we have even tapped into the potential of networking billions of physical objects, industry aspirations are visualizing an Internet of Everything, where not just objects and devices but everything, including people, process data and things are connected into one seamless and intelligent ecosystem.

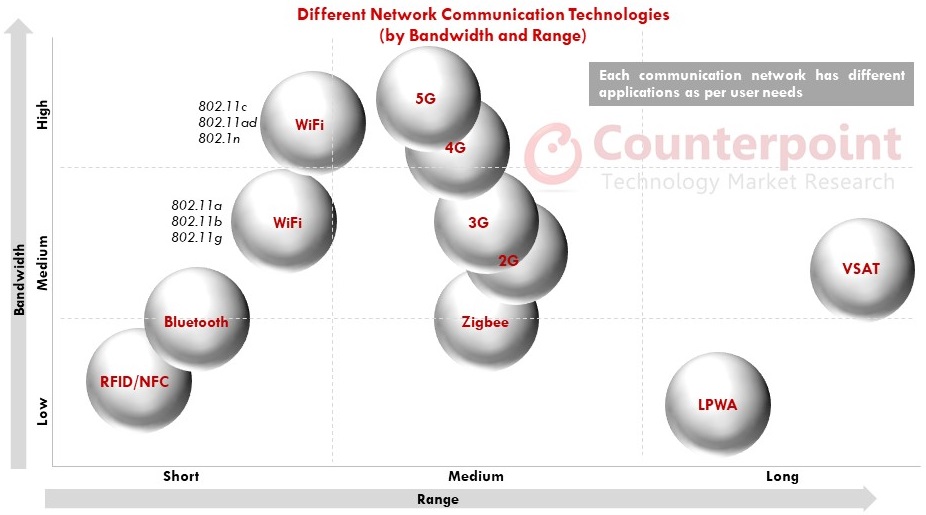

But whatever the breadth of the ambitions for IoT, the availability of quality connectivity options will eventually determine the value of the outcome. Today there are an overwhelming range of connectivity technologies on offer with a range of capabilities suited for different IoT applications.

Classifying IoT connectivity technologies

When it comes IoT connectivity, technology is constantly changing, with existing options being constantly updated and upgraded and new alternatives being continually introduced. And given the diversity of the IoT applications market, available solutions can be classified across a complex matrix of characteristics including range, bandwidth, power consumption, cost, ease of implementation, security, etc. But it is possible to classify these solutions using a simple 4 part taxonomy, namely:

- Classic connectivity solutions, comprising traditional short-range wireless solutions

- Non-cellular IoT, proprietary technologies deployed industry players/consortia.

- Cellular IoT, standardized technologies that operate in the licensed spectrum.

- Satellite IoT, for areas that cannot be covered by any of the above.

Both cellular and non-cellular IoT technologies fall under the broad, and rather self-explanatory, category of low-power wide-area networks or LPWANs. While the former is a standardized technology provided in the licensed spectrum by mobile network operators, the latter refers to private proprietary solutions operating in unlicensed radio frequencies. Both solutions, however, are purpose-designed for IoT and are capable of transmitting small packets of data across long distances, over an extended period, with very limited resource usage. The forecast for LPWAN technologies is that they will cover 100 percent of the global population by 2022.

1. Classic Connectivity:

There are a range of technologies that fall under this category, including Wi-Fi, Bluetooth and Bluetooth Low Energy, NFC, RFID, and mesh technologies such as ZigBee, Thread and Z-Wave. As mentioned earlier, these are all short-range solutions that are ideal for bounded environments such as smart homes for example. But if short-range seems like a limitation, these solutions make up for it by enabling high bandwidth transmissions at low power consumption rates. Most of these solutions may not be designed specifically for IoT. But as long as the requirement does not include long-distance data transmission, they could still serve as a crucial hub in a larger hybrid IoT environment.

2. Non-Cellular IoT:

There are currently two popular LPWAN solutions, LoRaWAN and Sigfox, in this space.

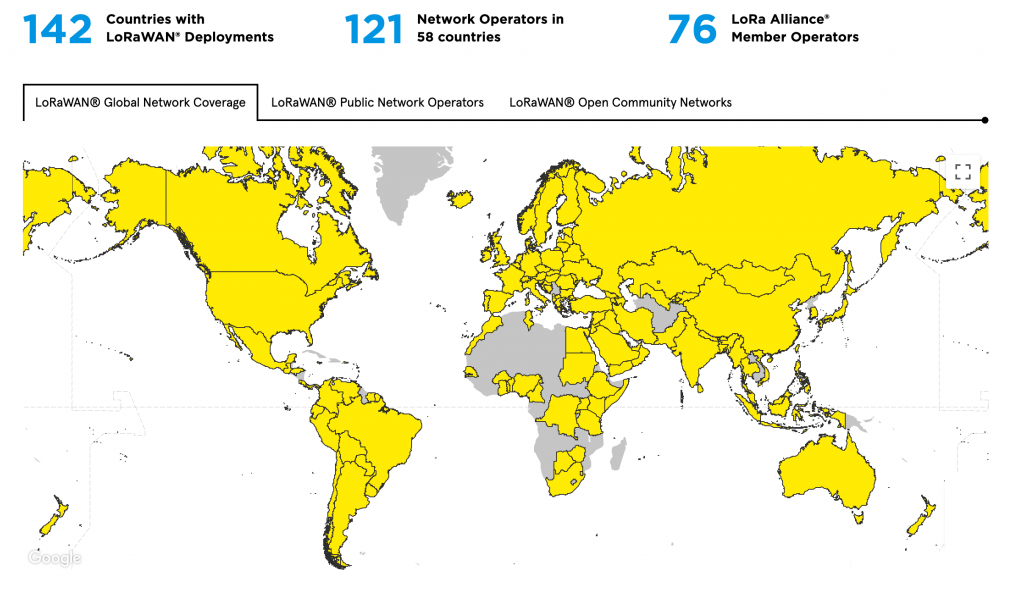

- LoRaWAN is an open IoT protocol for secure, carrier-grade LPWAN connectivity. It is backed by the LoRa Alliance, a global nonprofit association of telecoms, technology blue chips, hardware manufacturers, systems integrators, and sensor and semiconductor majors.

The protocol wireless connects battery operated ‘things’ to the internet, enabling low-cost, low-power, mobile and secure bi-directional communication. The solution can also scale from a single gateway installation to a global network of devices across IoT, M2M and other large-scale smart applications. Though the LoRaWAN protocol defines the technical implementation, it does not place any restrictions on type of deployment, giving customers the flexibility to innovate. One of the arguments challenging the technology’s open-standard credential has focused on implementation being tied to chips from LoRa Alliance member Semtech. However, other suppliers have recently announced an interest in adopting LoRa radio technology.

LoRaWAN already has a massive global footprint with over a 100 network operators having deployed its networks across the world by the end of 2018. The alliance also announced that it has tripled the number of end-devices connecting to its networks.

- Sigfox was one of the first companies to create a dedicated IoT network that used Ultra Narrow Band modulation in the 200 kHz public band to exchange radio messages over the air. The company’s stated ambition is to mitigate the cost and complexity of IoT adoption by eliminating the need for sensor batteries and reducing the dependence on expensive silicon modules.

The company’s proprietary protocol is designed for IoT applications that transmit data in infrequent short bursts across long distances, while ensuring low connectivity costs, and reducing energy consumption. It works with several large manufacturers such as STMicroelectronics, Atmel, and Texas Instruments for its endpoint modules in order to ensure the lowest cost for its customers.

The Sigfox network is currently operational in 60 countries, covering an estimated 1 billion people worldwide, connecting 6.2 million devices and transmitting 13 million messages each day. Sigfox has also teamed up with satellite operator Eutelsat to launch a satellite that will enable global coverage.

There are a few other players, like Link Labs and Weightless SIG, offering their own LPWAN technologies. But LoRaWAN and Sigfox dominate the market, accounting for nearly two-thirds of low-power wide-area networks deployments.

There is, however, a significant challenge emerging from their counterparts in cellular IoT with technologies like NB-IoT and LTE-M.

3. Cellular/Mobile IoT:

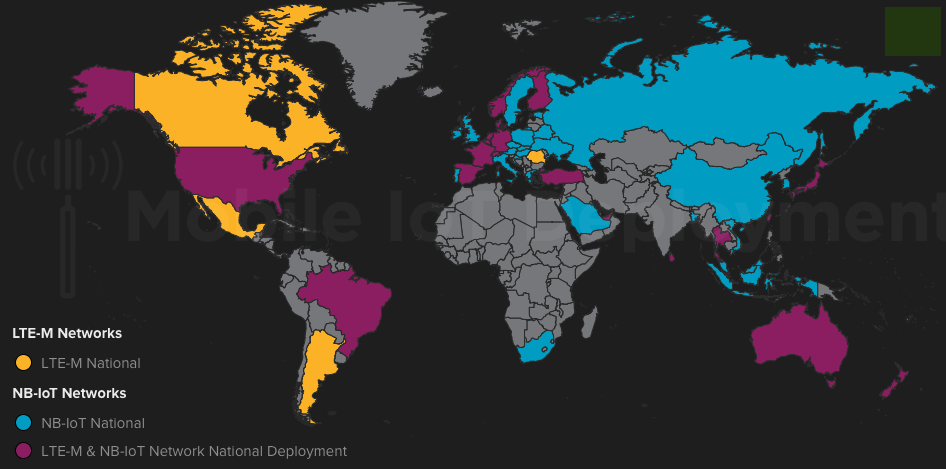

Proprietary technologies operating in the unlicensed spectrum may seem to have the market cornered, but cellular/mobile IoT is rapidly catching up. Earlier this year the GSMA announced the availability of mobile low-power wide-area IoT networks in 50 markets around the world with a total of 114 launches as of May 2019.

These launches include both LTE-M (LTE Cat-M/eMTC) and NarrowBand IoT (NB-IoT/LTE Cat-NB), a set of complementary, IoT-optimized cellular standards developed by the 3GPP (3rd Generation Partnership Project). Both these Mobile IoT networks are ideal for low-cost, low-power, long-range IoT applications and together they are positioned to address the entire spectrum of LPWAN needs across a range of industries and use cases. Operators have a choice of cellular technologies to ensure that they can provide clearly differentiated IoT services based on the market dynamics in their regions. And both these technologies can coexist with 2G, 3G and 4G networks. There are, however, some key distinctions between the two, stemming primarily from the focus on covering as wide a range of IoT applications as possible.

- LTE-M (Long Term Evolution for Machines) enables the reuse of existing LTE mobile network infrastructure base while reducing device complexity, lowering power consumption and extending coverage, including better indoor penetration. LTE-M standards are designed to deliver a 10X improvement in battery life and bring down module costs by as much as 50 percent when compared to standard LTE devices.

One significant development in the LTE-IoT market has been the launch of the MulteFire Alliance, a global consortium that wants to extend the benefits of LTE to the unlicensed spectrum. The group’s MulteFire LTE technology is built on 3GPP standards and will continue to evolve with those standards but operates in the unlicensed or shared spectrum. The objective is to blend the benefits of LTE with ease of deployment. Key features of the latest MulteFire Release 1.1 specifications include optimization for Industrial IoT, support for eMTC-U and NB-IoT-U, and access to new spectrum bands.

- NarrowBand IoT or NB-IoT is based on narrow band radio technology and is targeted at low-complexity low-performance cost-sensitive applications in the Massive IoT segment. The technology is relatively easier to design and deploy as it is not as complex as traditional cellular modules. In addition, it enhances network capacity as well as efficiency to support a massive number of low throughput connections over just 200khz of spectrum. NB-IoT can also be significantly more economical to deploy compared with other technologies as it eliminates the need for gateways by communicating directly with the primary server.

Both these technologies are already 5G-ready. They will continue to evolve to support 5G use cases and coexist with other 3GPP 5G technologies.

The race for 5G deployments has already begun in earnest. Following the launch of 5G services in South Korea and the US earlier this year, 16 more markets are expected to join this as yet exclusive club in 2018.

The emergence of 5G, the fifth generation of wireless mobile communications, will no doubt have a major impact on how these services are delivered. These fifth generation networks, with their promise of higher capacity, lower latency and energy/cost savings, have the potential to support more innovative bandwidth-intensive applications and massive machine-type communications (mMTC).

4. Satellite IoT:

This is ideal for remote areas that are not covered by cellular service. Though that may seem like a niche market, some reports indicate that there may be as many as 1,600 satellites dedicated to IoT applications over the next 5 years. Satellite communications company Iridium has partnered with Amazon Web Services to launch Iridium CloudConnect, the first satellite-powered cloud-based solution for Internet of Things (IoT) applications.

All of which brings up the question, which IoT protocol is right for you? Every technology discussed here has its USPs and its limitations. Every IoT application has its own requirements in terms of data rate, latency, deployment cost etc. A protocol that works perfectly well for a particular use case may prove to be completely inadequate for another.

So there is no one-size-fits-all protocol that can be prescribed by application or even by industry. As a matter of fact, sticking to just one technology standard doesn’t make sense in many Internet of Things (IoT) implementations, and that’s according to Sigfox.